Who Gets a 1099 - A Decision Tree for 2024

Who gets a 1099?

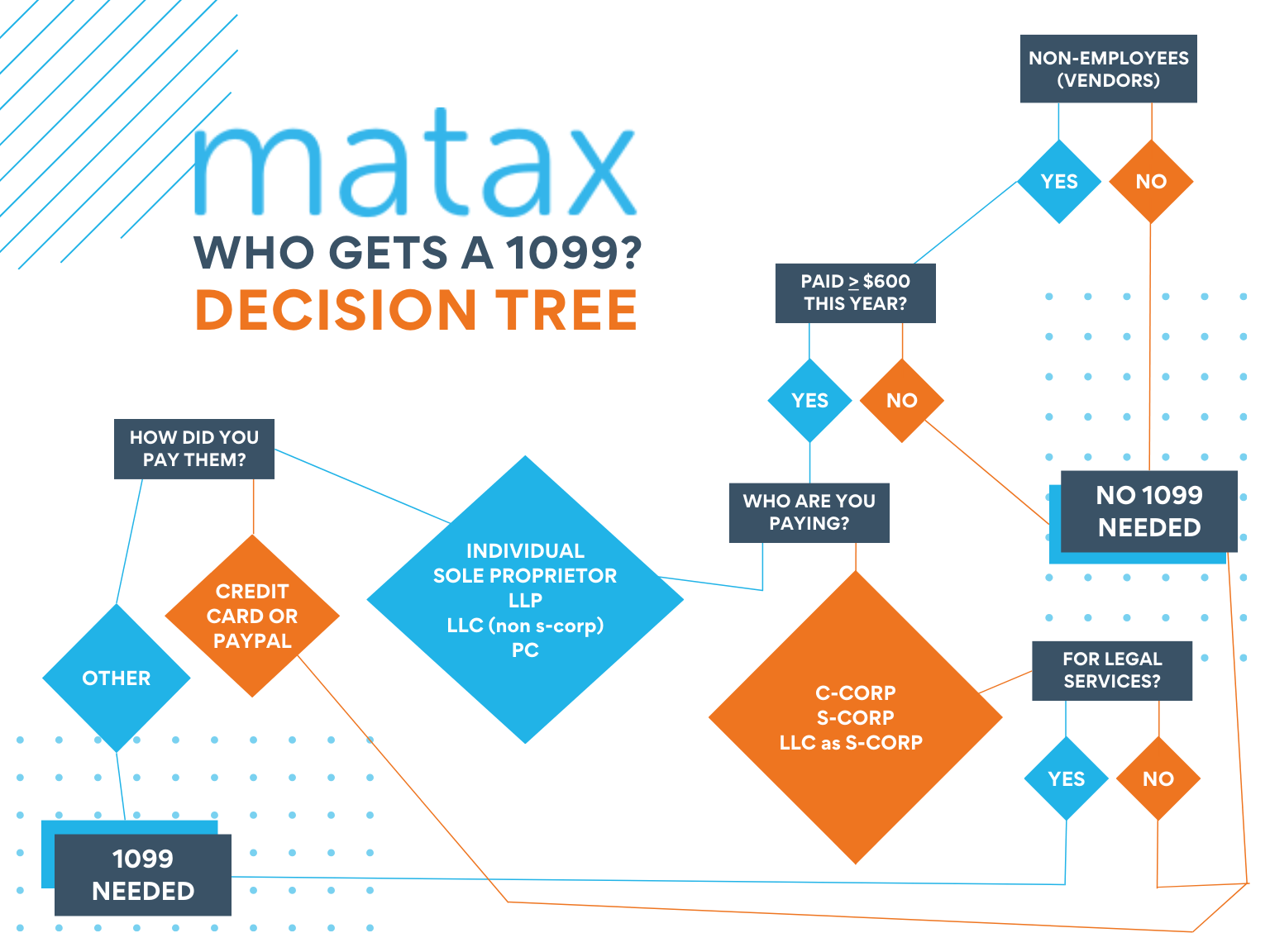

Trying to figure out which of your vendors need a 1099? Unfortunately, there’s not a simple answer. Of course, we could walk you through all the different case scenarios, but wouldn’t it be nice if there was an easier way? Like a 1099 decision tree. Well, we at MATAX have created just that. It doesn’t cover every exemption and scenario, but it’s a good foundation to get you started with the least amount of hassle. Check it out:

1099 Decision Tree for the 2024 / 2025 Tax Year

Okay, so the extremely short, general guideline is that all non-employees (vendors) to whom you pay more than $600 for services provided to your business in a calendar year need to receive a 1099. Of course, there are many particulars and some exceptions to this general guideline:

Rent payments to rental agents

Payments to entities regarded as tax-exempt organizations

Payments for storage, freight, merchandise, and the like

And there are exceptions to the exceptions of the general guideline. Here are the latest 1099 instructions from the IRS for all the details. But what about the different kinds of payments and different kinds of 1099 forms? Read on, dear friends.

What’s the difference between a 1099-NEC and 1099-MISC?

The 1099-NEC specifically focuses on reporting payments of $600 or more made to independent contractors, freelancers, or other non-employees for services rendered. On the other hand, the 1099-MISC is a broader form that covers various types of miscellaneous expenses, including rents, royalties, and certain other payments. The IRS introduced the 1099-NEC in 2020 to separate non-employee compensation reporting from the 1099-MISC, providing greater clarity for tax reporting purposes. For exhaustive lists and certainty, you’ll want to contact a tax professional, but for general clarity, here are some examples.

Payments that need to be reported on the 1099-NEC form include:

Services (including parts and materials)

Fees

Commissions

Prizes

Awards

Legal fees

Payments that need to be reported on the 1099-MISC form include:

Rents

Royalties

Medical and Health Care payments

Cash payments from your business to persons who are in the fish-catching trade or business

Fishing boat proceeds

Gross proceeds paid to an attorney

Deadlines for 2024 filing are as follows:

The 1099-NEC is due to vendors and to the IRS by January 31st, 2025, regardless of how it is being filed.

The 1099-MISC is due to vendors by January 31st, 2025, and should be reported to the IRS by March 1st, 2025 for paper filing and March 31st, 2025 for electronic filing.

If these deadlines fall on a weekend or public holiday, the deadline is pushed back to the following business day. Penalties for missing these deadlines include a fee of $60 to $310 per form in unintentional cases, and for intentional disregard, it’s a minimum of $630 or 10% of the reported income with no maximum.

Tips for Business Owners:

When you hire a new vendor, collect a W-9 from them prior to issuing their first payment. By doing so, you’ll have all the details from them you’ll need to issue a 1099, if they are eligible, making year-end much easier.

Use your accounting software to map eligible reporting categories so all you need to do at year-end is run a report to identify eligible vendors and payments.

When in doubt about whether or not a vendor or payments to a vendor need to be reported, contact a learned bookkeeper, accountant, EA, or CPA. If you do not yet have a trusted advisor on such matters, MATAX is here to help. Send us an email at admin@mataxhq.com or schedule a free consult.

No warranty or representation, expressed or implied, is made by MATAX Inc., nor does MATAX Inc. accept any liability with respect to the information and data set forth herein. Distribution hereof does not constitute legal, tax, accounting, investment, or other professional advice. Recipients should consult their professional advisors prior to acting on the information set forth herein.