Smart Founders Automate Accounting First

How AI-powered accounting systems help early-stage startups become ready for investors.

Picture this: You're deep in product development, sketching out the next breakthrough feature that could change everything. Your phone buzzes.

Another invoice to approve. Ten minutes later, you're updating spreadsheets instead of building the future. Sound familiar?

If you're building an AI startup or launching your venture in 2025, you know this frustration intimately. You started your company to solve big problems and create meaningful impact. Instead, you are stuck in back-office tasks. These tasks drain your energy and take time away from important work that makes a difference.

TL;DR: The Founder's Freedom Formula

Smart founders are finding that AI automation for accounting does more than save time. It gives early-stage startups a competitive edge. This can turn them into strong companies that attract investors.

By using AI-powered tools for startup accounting, founders can save 15-20 hours each week. This time can be used for strategic work. They also build a strong operational base that attracts investors and supports growth. The most successful business leaders scaling in 2025 share one trait: they automated their accounting for startups early and focused their energy on what only founders can do.

The best founders we work with found something important: the right business automation saves time. It provides a competitive advantage. This helps to grow faster, attract investors, and maintain the founder's motivation to create something great.

The Hidden Time Tax That's Killing Your Momentum

Here's the reality most founders don't want to admit: manual startup accounting processes are secretly destroying your potential. We've tracked this across hundreds of founders, and the numbers reveal the true cost of operational inefficiency.

The True Cost of Manual Startup Operations:

15-20 hours per week spent on accounting for startups and administrative tasks

Lost productivity that compounds every week

Strategic time redirected from product development and customer acquisition

Mental bandwidth consumed by back office operations instead of breakthrough innovation

The average founder spends 15 to 20 hours each week on startup accounting and back office tasks. This time should be used for product development, gaining customers, and planning strategies. That's lost opportunity cost that compounds every week.

Think about it: those 20 hours could be spent having critical customer conversations, refining your AI models, or developing strategic partnerships. Instead, you're reconciling bank statements and chasing receipts.

One founder realized they were spending more time managing their books than managing their actual business. When they implemented AI automation and Xero accounting services, they suddenly had 18 hours per week back. That's when everything changed—they accelerated product development, closed three major partnerships, and raised their Series A six months ahead of schedule.

This isn't about avoiding responsibility. It's about recognizing that your time as a business leader is your startup's most valuable resource. Every hour spent on manual startup accounting is an hour not spent building the future you envision.

The Investor Confidence Stack: What VCs Actually Look For

When investors evaluate early-stage startups, they're assessing your operational maturity and ability to scale systematically. The startups that receive funding have what we call the "Investor Confidence Stack." This includes AI-powered tools and automation. These tools show that the startup operates professionally from day one.

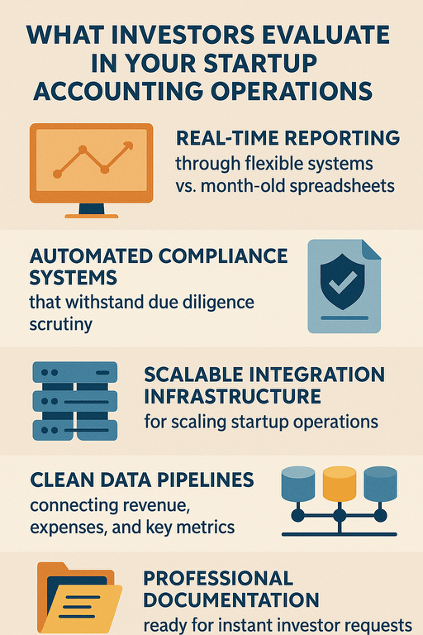

What Investors Evaluate in Your Startup Accounting Operations:

Real-time reporting through flexible systems vs. month-old spreadsheets

Automated compliance systems that withstand due diligence scrutiny

Scalable integration infrastructure for scaling startup operations

Clean data pipelines connecting revenue, expenses, and key metrics

Professional documentation ready for instant investor requests

Real-Time Accounting Visibility

Modern investors expect real-time access to your performance metrics. They want clean, automated reporting that updates continuously rather than manual calculations. This means AI-powered integrations that track revenue, expenses, and key metrics automatically through system integration.

A founder recently raised $2 million in seed funding. They said, "Investors were impressed that we could answer any accounting question immediately." Our automation tools showed operational discipline for scaling startup operations efficiently. That professionalism differentiated us from other startups."

Scalable Infrastructure for Different Business Models

Investors bet on your future, not just your present. They need to see accounting for startups systems that handle 10x growth without breaking down. The startups that secure funding demonstrate scalability through workflow optimization that strengthens rather than strains as companies grow.

From Reactive Scrambling to Proactive Strategy

The most transformative benefit of AI automation isn't just operational efficiency—it's strategic insight from clean, real-time data. When your startup accounting runs automatically, you shift from reactive scrambling to proactive strategy.

How AI-Powered Accounting Transforms Decision-Making:

Pattern Recognition: Identify which customer segments drive highest lifetime value

Channel Optimization: Discover which marketing produces most efficient acquisition

Feature Correlation: Connect product usage patterns with revenue expansion

Predictive Planning: Model growth scenarios automatically vs. manual forecasting

Resource Allocation: Make data-driven hiring and investment decisions in real-time

Pattern Recognition That Drives Growth

Ai-powered integrations identify patterns humans miss. Which customer segments have highest lifetime value? What marketing channels produce efficient customer acquisition? Which product features correlate with revenue expansion? Automation tools surface these insights continuously.

One founder of an AI-powered logistics startup discovered: "Our automated analytics revealed enterprise customers using three specific features had 300% higher retention rates. We restructured our onboarding process around those insights and reduced churn by 40%."

Predictive Planning for Successful Business Growth

Traditional accounting looks backward. AI-enhanced startup accounting looks forward. These systems predict cash flow needs, identify potential shortfalls before they happen, and model different growth scenarios automatically. This transforms business planning from guesswork into strategic advantage for any successful business.

The Automation Roadmap: Building for Scale

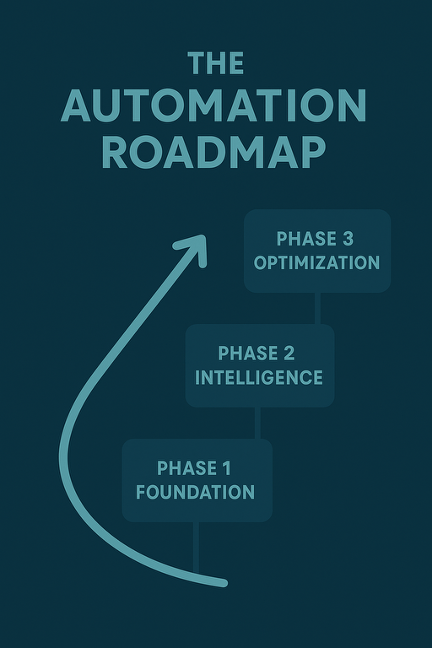

The key to successful business automation isn't implementing everything at once—it's building a foundation that scales systematically. We've developed a proven roadmap that takes startups from operational chaos to investor-ready excellence.

Phase 1: Foundation (Months 1-2)

Automated bank feeds and expense categorization

Document processing and digital receipt management

Basic reporting templates through Xero accounting services

Clean data pipelines for future intelligence layers

Phase 2: Intelligence (Months 3-4)

Real-time dashboards tracking key business values

Email automation for invoice generation and payment processing

System integration connecting CRM with accounting for startups

Investor-ready reports that populate automatically

Phase 3: Optimization (Months 5-6)

Predictive cash flow forecasting for scaling startup operations

Meeting automation for compliance monitoring

Slack automation for team productivity alerts

Advanced AI-powered integrations connecting all business functions

Start with automated accounting for startups and expense management. Connect bank accounts, implement document processing, and establish automated categorization. This foundation eliminates daily administrative burden while creating clean data for future insights.

Focus on Xero accounting services with automated bank feeds, expense tracking, and basic reporting templates. The goal is eliminating manual data entry and creating reliable records for your successful business.

Layer in analytics and workflow optimization. Create dashboards to track important business values. Set up email automation for invoicing. Make reports for investors that update in real-time. This phase transforms raw data into actionable insights.

Link customer relationship management with startup accounting using system integration. Set up automated revenue recognition for SaaS startup models. Create board report templates that fill in automatically.

Add predictive analytics and advanced AI automation. Implement cash flow forecasting, meeting automation for compliance monitoring, and scenario planning tools. This phase creates competitive advantages through strategic intelligence.

Integration Excellence for Increased Productivity

The most successful implementations connect automation tools across the entire business ecosystem. Customer data flows from CRM into revenue recognition systems. Product usage metrics connect with performance analytics through AI-powered integrations. Marketing spend ties directly to customer acquisition costs and lifetime value calculations.

This creates unified business performance views that transform decision-making speed and accuracy. Instead of quarterly reviews based on stale data, you have continuous workflow optimization based on real-time insights.

Work-Life Harmony for Sustainable Success

Founders who build lasting companies understand that sustainability matters more than short-term heroics. Business automation enables work-life harmony essential for long-term success by eliminating evening and weekend administrative work that burns out dedicated entrepreneurs.

How Accounting Automation Transforms Founder Life:

Reclaimed Time: 15-20 hours per week redirected to strategic activities

Reduced Stress: Elimination of manual bookkeeping anxiety

Decision Clarity: Real-time data through flexible systems replaces guesswork

Energy Preservation: Mental bandwidth saved for breakthrough innovation

Sustainable Growth: Systems enabling scaling startup operations without constant founder intervention

When your startup accounting runs on its own, you get back time for important tasks only founders can do. These tasks include building vision, developing strategy, nurturing key relationships, and keeping the creative energy needed for new ideas.

One founder of an AI education platform shares their experience: "Before AI automation, I worked 80-hour weeks. I still fell behind on back office tasks." Now I work 55-hour weeks with better operational control. "We used that extra energy for product innovation. We launched three major features because we had more time to think strategically."

Real Success Stories: AI Automation in Action

The most compelling evidence comes from founders who've experienced this transformation firsthand. Their stories illustrate how strategic business automation creates competitive advantages that compound over time.

The AI Healthcare Breakthrough

One founder launched an AI diagnostic platform with ambitious goals but limited operational experience. Within three months of implementing AI-powered integrations for startup accounting, they raised $1.5M in seed funding. The automation tools impressed potential backers, but more importantly, time savings allowed focus on clinical partnerships that became the foundation for rapid growth.

"Automated compliance reporting was crucial during due diligence," the founder explains. "While other startups scrambled to prepare documentation, we had everything ready instantly through our flexible systems. That professionalism helped us close funding 40% faster than projected."

The Remote-First AI Company

One founder built a distributed AI development team across three continents. Manual coordination was impossible given time zones and communication complexity. Business automation and slack automation created seamless operations that worked regardless of geography.

The AI automation enabled rapid scaling without operational friction. The company grew from 8 to 30 employees while maintaining the same back-office operations overhead. This operational efficiency impressed Series A investors and contributed to a successful $5M funding round.

The Partnership Advantage: Why Smart Founders Delegate

Building automated accounting systems internally seems appealing until you calculate real costs. Developing expertise while building your core product creates competing priorities that slow progress on both fronts.

Why Smart Business Leaders Partner for Startup Accounting:

Expertise Acceleration: Years of startup-specific experience vs. learning from scratch

Proven Integration ROI: Tested automation tools vs. experimental approaches

Focus Preservation: Core product development vs. building accounting systems

Scalable Growth: Flexible systems that evolve vs. constant rebuilding

Cost Efficiency: Fraction of in-house development costs

Expertise Acceleration for Operational Efficiency

Specialists in accounting for startups bring years of experience across multiple companies. They understand specific compliance requirements for AI companies, investor reporting standards that matter, and system integration strategies that create seamless startup operations.

Working with experts means avoiding expensive mistakes that derail internal implementations. You get reliable automation tools instead of untested methods. You receive tested AI-powered integrations instead of custom development. You also benefit from ongoing workflow improvements instead of one-time setups.

Strategic Focus Preservation

Your competitive advantage comes from unique vision and execution, not building accounting systems. Partnering with specialists preserves strategic focus while creating best-in-class operational capabilities for your successful business.

Think of it as building your startup's operating system. You wouldn't develop your own programming language—you use proven tools that enable faster development. Business automation follows the same logic.

Your Next Move: From Vision to Action

The most successful business leaders we work with share one characteristic: they act decisively when recognizing opportunities for competitive advantage. Startup accounting automation isn't just about operational efficiency—it's about creating the foundation that enables extraordinary outcomes.

The Founder's Quick Assessment Checklist:

Time Audit: How many hours per week do you spend on accounting for startups?

Decision Delays: What strategic choices wait because you lack real-time data?

Investor Readiness: How quickly can you produce clean reports for potential backers?

Scaling Concerns: Will current processes handle scaling startup operations 10x?

Energy Drain: How much mental bandwidth goes to back office operations?

The Opportunity Cost of Waiting

Every week you delay implementing business automation is a week of lost strategic time, missed opportunities for better decision-making, and additional stress from manual operational complexity. Founders who implement early create compounding advantages that accelerate every aspect of their business.

Begin with a simple assessment: How much time do you spend on startup accounting and administrative tasks? What decisions do you delay because you lack real-time data? How often do investor conversations stall because you can't produce documentation quickly?

These questions reveal specific opportunities AI automation can address. Most founders discover the potential impact exceeds initial expectations.

Building the Future You Envision

You didn't start your company to become an accountant. You started it to solve meaningful problems, create lasting impact, and build something extraordinary. Business automation doesn't just support that vision—it amplifies it by removing operational friction that slows progress.

The best business leaders in 2025 will have some key traits. They will use automated startup operations that grow easily. They will rely on real-time insights for better decision-making. Founders will also keep the energy and focus needed for great innovation.

This isn't about choosing between growth and operational excellence. It's about using AI automation to achieve both simultaneously while preserving founder energy needed for long-term success.

The future belongs to business leaders who build strategically from day one. Those who implement automation tools early create sustainable competitive advantages that compound over time. They attract better investors, make faster decisions, and scale more efficiently.

Most importantly, they maintain the passion and energy that inspired them to start their companies in the first place.

Ready to reclaim your time and accelerate your growth? Let's look at how AI-powered tools and Xero accounting services can change your startup's path. This way, you can keep your focus on what matters most.

Your breakthrough moment is waiting. The only question is how quickly you're ready to seize it.

About the Author

Dawn Hatch, Founding Partner & Xero Partner Advisory Council Member

Dawn Hatch founded MATAX after experiencing firsthand how proper accounting and integrated processes transform business success. With decades of startup experience, she's witnessed the patterns that separate companies scaling efficiently from those struggling under operational complexity.

As a two-time Xero Partner of the Year and XPAC member, Dawn specializes in helping startup founders harness accounting technology and ethical AI to streamline operations. Her approach combines technical expertise with genuine understanding of the founder journey—balancing vision-building with the practical realities of running a growing company.

Through MATAX, Dawn has helped hundreds of startups build investor-ready operations, implement scalable systems, and reclaim time needed for breakthrough innovation. She believes sustainable business growth comes from building systems that support both professional success and personal well-being.

Connect with Dawn to explore how automated accounting systems can accelerate your startup's growth. founders are finding that AI automation for accounting does more than save time. It gives early-stage startups a competitive edge. This can turn them into strong companies that attract investors.